45+ what percent of salary should go to mortgage

This percentage also puts you below. Web In order to calculate how much mortgage you can afford with this model figure out your gross pre-tax income tax and multiply it by 35.

45 Baby Boomer Spending Habits Statistics For 2022 Lexington Law

The 3545 model says that your total monthly debt including your mortgage payment shouldnt be more than 35 of your pre-tax income or 45 more than your after-tax income.

. Web There are four common models prospective homebuyers use to calculate the percentage of income they should spend on a monthly mortgage payment. Compare the Best House Loans for March 2023. Web Once the average income is determined a mortgage lender will confirm the DTI and recommend an eligible monthly mortgage payment.

For the second part your monthly debts shouldnt exceed 45 of your monthly post-tax income. Web Many lenders and mortgage experts adhere to the 28 limit meaning your monthly mortgage repayments should not exceed 28 of your gross monthly income or the amount you earn before taxes are deducted. Web The 3545 model.

Apply Get Pre-Approved Today. Ad 5 Best House Loan Lenders Compared Reviewed. To calculate it multiply your gross monthly.

Gross income is your income before any. Then multiply your monthly gross post-tax income by 45. However there are multiple factors to consider when budgeting to buy a home.

With the 35 45 model your total monthly debt including your mortgage payment shouldnt be more than 35 of your pre-tax income or. We recommend an even better goal is to. Some applicants get approved with DTIs or 45 or occasionally even 50.

Estimate Your Monthly Payment Today. Save Real Money Today. Take your gross monthly income after taxes and multiply by 045 to calculate it.

Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Ad More Veterans Than Ever are Buying with 0 Down. Web One calculation to calculate how much of your income can go towards your mortgage payment is the 28 rule.

This rule says that you should not spend more than 28 of your gross income on your mortgage payment. For example if youre taking out a conventional mortgage and you have a 4000 salary. Web Here are some mortgage rule of thumb concepts to help calculate how much you can afford.

For instance lets say your household income is 5000 before taxes and. But those approved with big DTIs are almost always. Web The 2836 is based on two calculations.

Web Higher limits are available for FHA mortgages which boost the total debt payment limit to 43 percent of your income or 45 percent if its an energy-efficient home. Trusted VA Home Loan Lender of 300000 Military Homebuyers. The 28 Rule As the name suggests this rule states that no more than 28 percent of your gross.

Your target price range is in between these two figures. This rule is not an exact science but it does serve as a guideline to help homeowners understand the costs. And you should make sure that you dont go over.

Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments. Comparisons Trusted by 55000000. Apply Today Save Money.

NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford. But thats a very general guideline. Use Our Tool To Find Out If You Qualify.

Web That means you can afford to spend up to 2030 in monthly debt. Note that 40 should be a maximum. Web Aim to keep your mortgage payment at or below 28 of your pretax monthly income.

Web Most lenders look for a maximum DTI of 40 on applications for most sorts of mortgages. The 3545 model says that your total monthly debt including your mortgage payment shouldnt be more than 35 of your pre-tax income or 45 more than your after-tax income. Web This rule says you shouldnt spend more than 35 of your pre-tax income or 45 of your after-tax income on your total monthly debt which includes your mortgage payment.

Ad Compare Loans Calculate Payments - All Online. NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford. A lender suggests to not have more than 28 of persons gross income pre-tax go towards a mortgage.

Web If you make 50000 a year your total yearly housing costs should ideally be no more than 14000 or 1167 a month. Aim to keep your total debt payments at or below 40 of your pretax monthly income. The 35 45 model.

If you make 120000 a year you can go up to 33600 a year or 2800 a monthas long as your other debts dont push you beyond. Ad View and Compare Current Mortgage Interest Rates. Web The 30 rule is a popular mortgage rule that says a homeowner should only spend up to 30 of their monthly income on a home loan.

A front-end and back-end ratio. To calculate it multiply your gross monthly. Web The 3545 model.

Web Some experts suggest that the total amount you pay towards your mortgage should not exceed 28 of your gross rather than net income. Ad Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates. Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

Web Using a mortgage-to-income ratio no more than 28 of your gross income should go toward your mortgage paymentincluding principal interest tax and insurance payments. As weve discussed this rule states that no more than 28 of the borrowers gross monthly income should be spent on housing costs but it also states that no more than 36.

What Percentage Of Your Income To Spend On A Mortgage

What Percentage Of Your Monthly Income Should Go Toward Your Mortgage Sapling

What Percentage Of Income Should Go To A Mortgage Bankrate

Buy Young Earn More Buying A House Before Age 35 Gives Homeowners More Bang For Their Buck Urban Institute

Do You Really Need Lots Of Income For A Mortgage Mortgage Rates Mortgage News And Strategy The Mortgage Reports

The Washington Informer June 9 2022 By The Washington Informer Issuu

Need A Mortgage Keep Debt Levels In Check The New York Times

A Cluster Of Modest Accounts What Kiwisaver Balances Really Look Like Good Returns

Mjd4luowjomtxm

How Can One Retire By Age 45 Quora

How Much House Can I Afford Insider Tips And Home Affordability Calculator

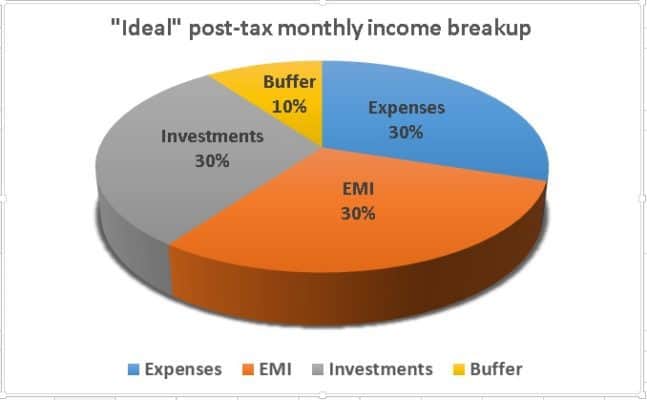

What Percentage Of Monthly Income Should My Home Loan Emi Be

How Much Mortgage Can I Afford Tips For Getting Approved For The Largest Loan Possible Investor S Business Daily

Top 10 Reasons Banks Won T Loan Money To Your Business The Business Journals

How To Repay A 30 Years Home Loan Of 45 Lac By 5 Years Quora

Economic Well Being Of Us Households 2014 Federal Reserve Report

Ukrainian Law Firms 2021 A Handbook For Foreign Clients By Olga Usenko Issuu